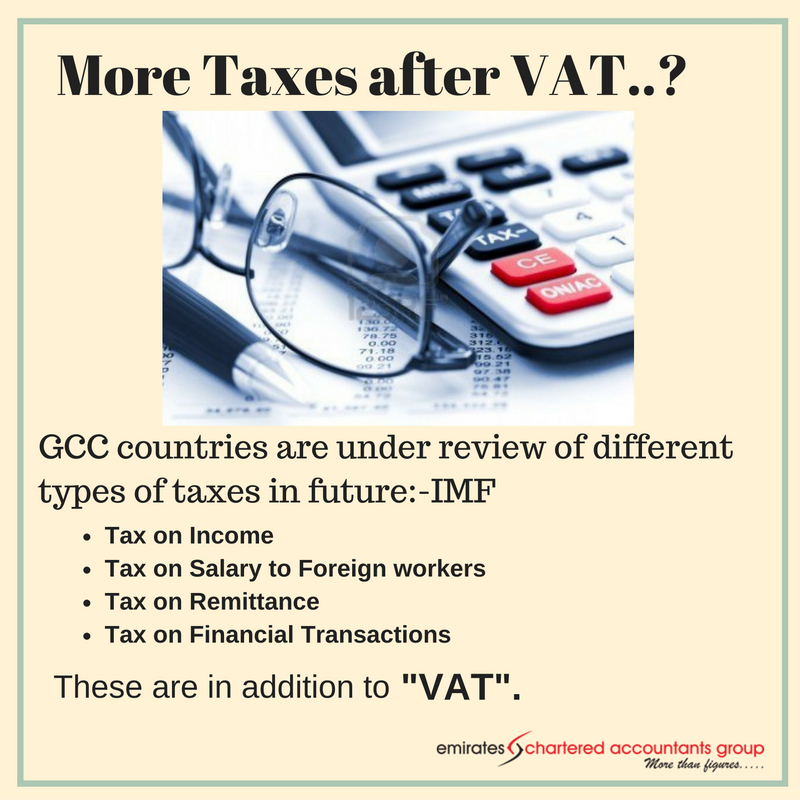

More Taxes after VAT…?

The GCC countries are considering several additional reforms, including 10 to 15 percent tax on business profits, to raise non-oil revenue in the years ahead following the introduction of value added tax (VAT) in 2018, the International Monetary Fund (IMF) officials disclosed in a report.

The additional reforms also include taxes on remittances, taxes on income and wages paid to foreign workers and taxes on financial transactions, the IMF staff report prepared following the October meeting of GCC finance ministers and central bank governors in Riyadh revealed.

“Over time, the GCC countries, which have intensified their efforts to diversify budget revenues as part of their broader fiscal consolidation strategies, should also move to introduce or expand the tax on business profits. This, together with the VAT and excises will help ensure efficient and progressive tax systems in the region and generate the bulk of non-oil tax revenues for most countries’ budgets,” said the report titled ‘Diversifying government revenues in the GCC: Next steps’.

Like VAT, the business profit tax should start simple and be levied at a single (relatively) low rate for all businesses, argued the IMF paper, which discusses how to diversify government revenues in the GCC in the face of the sharp decline in oil revenues and the emergence of large fiscal deficits.

source: Khaleej Times